The spdr s&p biotech etf (xbi) is another broad biotech fund, but is very different from ibb above. Invesco s&p smallcap health care etf (psch)expense ratio:

Renko Biotech Position Trading For The Xbi Etf Position Trading Implied Volatility Trading Charts

The fund will normally invest at least 90% of its total assets in the securities that comprise the index.

Small cap biotech etf. Yet this combo could be an attractive invitation to examine with the defiance nasdaq junior biotechnology etf (ibbj). Pbe holds around 30 companies. In 2017, large biotech companies have had trouble keeping pace with their smaller peers, as slower sales weighed.

The virtus lifesci biotech clinical trials etf ( bbc) invests in clinical trials stage biotechnology companies. Small cap stocks are retreating. Memeification of biotech stocks shines light on this etf.

The following table presents holdings data for all etfs tracking the s&p smallcap 600 health care index. Small is best for biotech etfs. As the chart above clearly shows, the relative valuation of the small cap biotech fund, alps medical breakthroughs etf (nysearca:sbio), compared to the nasdaq 100 fund [qqq was around 0.26 at the.

The invesco s&p smallcap information technology etf (fund) is based on the s&p smallcap 600 ® capped information technology index (index). The index is designed to measure the overall performance of the securities of us information technology. Below is a small sample of companies whose stocks may qualify for investment by biotech etfs, though there can be many more businesses and financial instruments where these etfs can.

Since some of those are small cap names, this can be a way for investors to get some of the benefits associated with small biotech firms while mitigating part of the risk with more familiar sector names. The following table presents dividend information for etfs tracking the s&p smallcap 600 health care index , including yield and dividend date. We examine the top three biotech etfs below.

Launched in august 2020, the defiance nasdaq junior biotechnology etf is. Pbe began trading four years ago (june 2005) and has a net expense ratio of 0.63%. “they are also strengthened by increased patient lobbying and greater willingness by insurers to pay for treatments.”

The spdr s&p biotech etf (nysemkt:xbi) seeks to track the s&p biotechnology select industry index. Defiance nasdaq junior biotechnology etf (nasdaq:ibbj) aum: These are typically younger, smaller companies, which do not have a drug approved.

All numbers are as of aug. Today, defiance etfs launched a third etf, this one with a focus on small cap biotechnology companies.

Day Trading Renko Charts Instead Of Tick Bar Charts Trading Charts Day Trading Chart

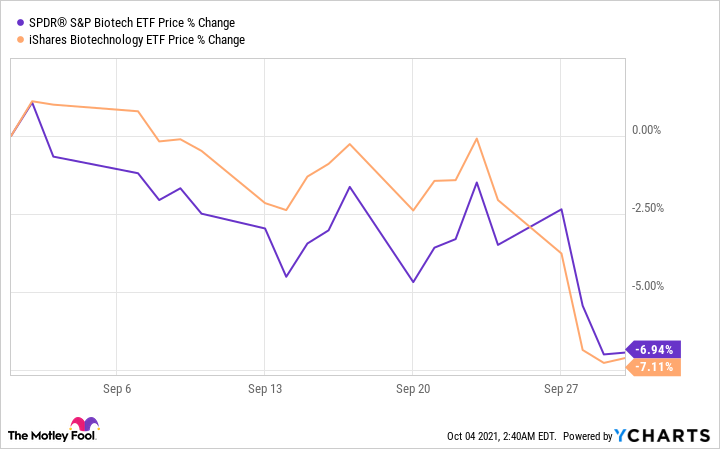

3 Biotech Etfs That Could Double Your Money By 2025 With Zero Effort The Motley Fool

How Im Playing The Red-hot Small-cap Biotech Stocks Investing Whisperer

Spdr Sp Biotech Etf A Closer Look The Motley Fool

Home - Renko Chart Trading Trading Charts Trading Strategies Implied Volatility

Historic Opportunity Afoot In Biotech Investing Nasdaq

2 Best Biotech Stocks To Buy In October The Motley Fool

Pin On Economy

Utilities Select Sector Spdr Stock Charts Equity Market The Selection

Pin On 3d Printed Medical Biotech

Two Stocks To Play A Biotech Bottom Bethtechnology In 2021 Two Stock Bottom Stock

Renko Trade Setup Filters Trading Charts Implied Volatility Trading

Pin On Stock Charts

The Top 3 Biotech Etfs On The Market The Motley Fool

Yesterdays Stock Market Rally Created A New Short Selling Opportunity In Spdr Homebuilders Etf Xhb Click The Stock Market Game Swing Trading Stock Market

Yesterdays Stock Market Rally Created A New Short Selling Opportunity In Spdr Homebuilders Etf Xhb Click The Stock Market Game Swing Trading Stock Market

Pin On Stocks

3 Biotech Etfs That Could Double Your Money By 2025 With Zero Effort The Motley Fool

Pin On Trading